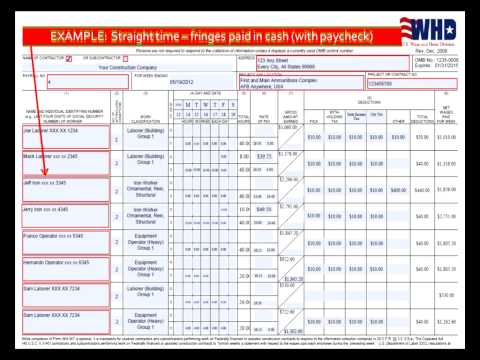

Hello and welcome to a how-to guide on creating the certified payroll report for federal Davis-Bacon prevailing wage projects. A certified payroll report certifies to a public agency that the appropriate prevailing wages were paid to each worker. It also facilitates the reporting of fringe benefit payments that are made to individuals and to approved bona fide benefit plans. It is a requirement on construction projects built under the federal Davis-Bacon and DBRA (Davis-Bacon Related Acts). These certified payroll reports must be submitted on a weekly basis. Here's an example of a weekly certified payroll report form. You'll note that there are several forms available out there for your use on most projects. Your labor compliance program may require a specific form, and in that case, you should comply. However, it should be noted that most labor compliance programs and federal agencies will accept printouts from your full job cost accounting software packages as long as they understand where all the information is. The form we are going to be using today is a federal form that is optional. As long as you submit your payrolls to them with all the information on them, they cannot mandate what form it comes in. Here's a public works payroll reporting form for the Department of Industrial Relations in the state of California. You'll see that it even has a different look. Regardless of what the form looks like, all must be accompanied by a statement of compliance. This will be signed by the person paying or supervising the payment of employees working on a prevailing wage project, and it must accompany every weekly certified payroll report. Once you begin working on the project, payroll reports must be filled out and submitted for every week thereafter, even when you have no work on weeks. If you...

Award-winning PDF software

WH-380-F Form: What You Should Know

Here: Download File.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form WH-380-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form WH-380-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form WH-380-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form WH-380-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form WH-380-F